The shift to Omni-channel Distribution insurance distribution

In today's insurance landscape, channel proliferation and product innovation are driving hugely diverse demands on engagement patterns. To stay competitive, carriers are shifting from siloed solutions to unified, Omni-channel Distribution distribution platforms.

Why Omni-Channel Distribution Platform

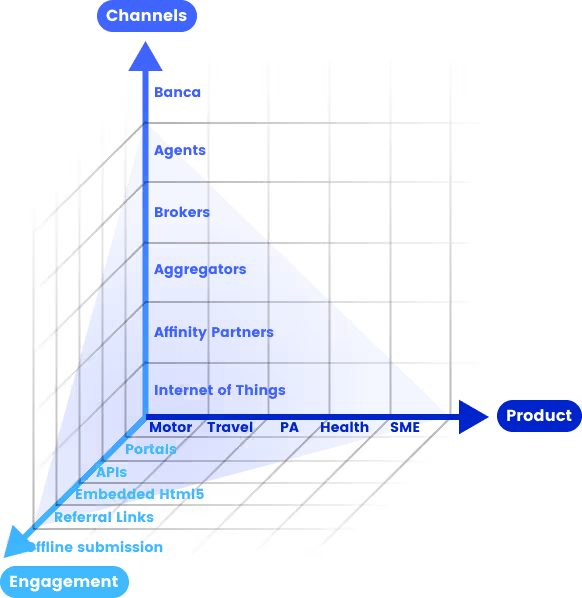

All Products, each in its own way

Supports the full spectrum of property & casualty and life & health products - individual or group, mainstream or micro, traditional or modern - each running its own way without being locked into rigid structures.

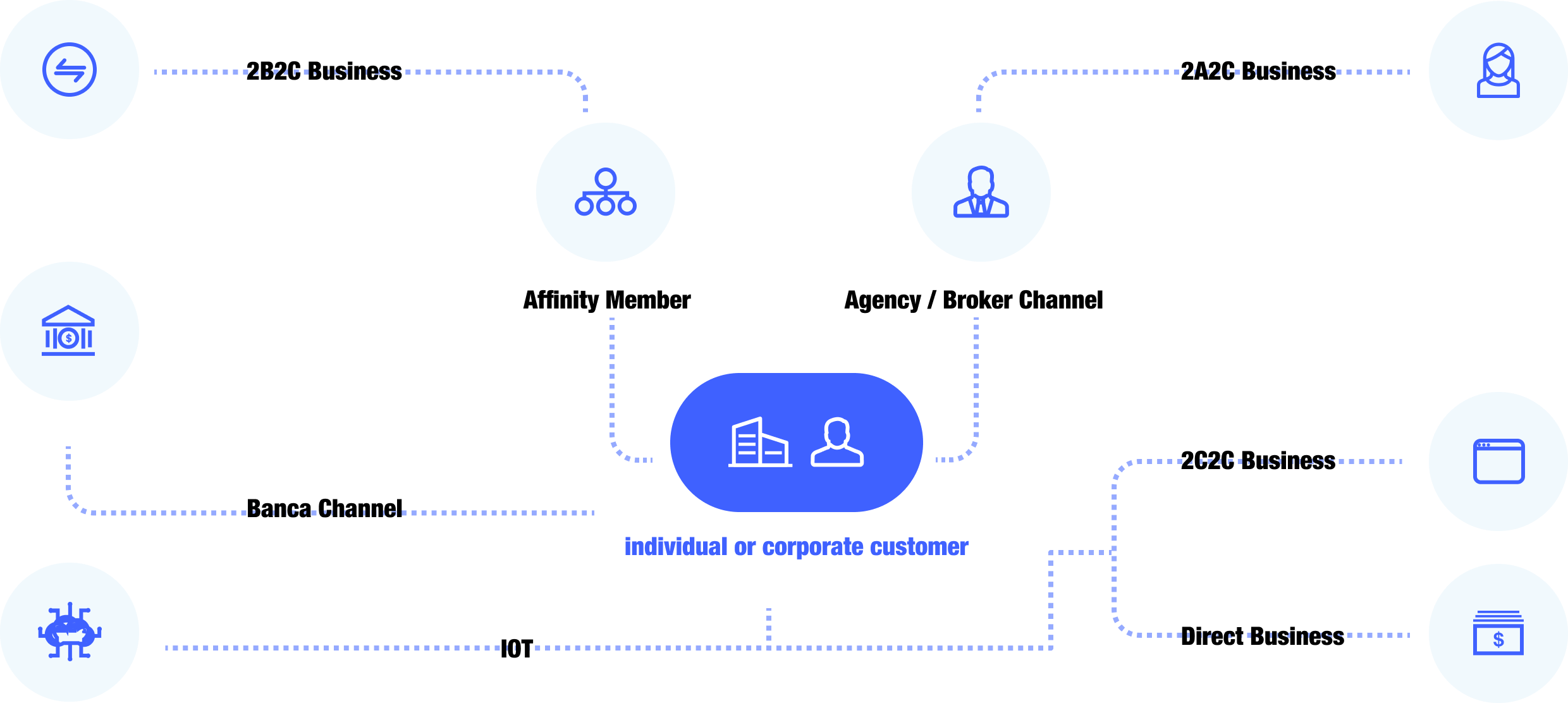

All Channels, traditional or emerging

The platform empowers not only agents, brokers, bancassurance, affinity, direct, and IoT channels, but also emerging models such as B2A2C, B2B2C, and B2C2C.

All engagement patterns

Out-of-the-box customer and intermediary portals, embedded purchase journeys, white-labeled portals, referral redirection, bulk file uploads, and API integrations to support the diverse needs in marketplace.

Powerful CRM 360 & campagins

The in-built CRM provides a 360 view of each customer and every interaction throughout the sales process, supported by end-to-end dynamic campaigns with configurable discounts, rewards, and gift management.

Comprehensive channel management

A seamless, end-to-end process covering every stage - from channel onboarding and e-learning to authorization, compensation, and performance analytics.

Trusted By

Impact at a glance

Testimonials

One-stop service station beyond sales

It's not only about sales, but also one-stop services for customers, intermediaries and partners through our in-built portals and APIs, where self-services is available everywhere, including endorsements, renewal, payments, statements, SOAs, and much more.

Channel ochestration

Intermediaries can white-label A2C websites for direct sales, partners can do the same for B2C, and C2C referrals are embedded throughout every sales and service journey. All channels are orchestrated on the Omni-Channel Distribution Platform to maximize connections and unlock sales potential.

Transform carriers into a technology powerhouse

Set up a developer enablement portal to publish APIs and embedded journeys, allowing partners to self-register, integrate, and connect seamlessly to the Omni-Channel Distribution Platform - accelerating ecosystem growth at near-zero cost.

Add-ons

Policy Administration

Enable full back-end capability to a full policy administration platform.

AI Middle Office

Unleash the full power of your stack: seamlessly orchestrate native AI with every API to build end-to-end intelligent automation.

Partner Solutions

Explore plug-in solutions from our partners.

Discover More

Dai Ichi Life Myanmar awarded the 'Insurance Distribution' Initiative of the Year

[Singapore] Dai-ichi Life Myanmar has been awarded the “Insurance Distribution Initiative of the Year - Myanmar” at the Insurance Asia Awards 2025 in Singapore.

Takaful Malaysia won 'Innovation' and 'Direct Distribution' awards by the Malaysian Takaful Association

[Kuala Lumpur] Takaful Malaysia has been honored with the 'Innovation' and 'Direct Distribution' awards by the Malaysian Takaful Association (MTA), recognizing the company's excellence in advancing the distribution of takaful family plans.

Sompo Singapore launched new iChannel platform

[Singapore] Sompo Insurance Singapore has successfully rolled out its new iChannel platform, powered by Bytesforce Technologies' InsurerMate, a next-generation, cloud-native insurance core and distribution solution. The launch marks a significant milestone in Sompo Singapore's digital transformation journey, enhancing efficiency and empowering its agent and partner network through seamless digital capabilities.